By Juliana Yao, Co-Opinion Editor

One — that’s the number of corporations there are predicted to be per industry in the U.S. by 2070 with our current rate of corporate consolidation, according to the Economic Security Project.

Mergers and consolidation have been at an all-time high, and this concerning trend is becoming ever more apparent in our own community. Just this spring, a large organization acquired my pediatrician’s office. The more I looked at our area, the more I found that independent clinics and even larger hospital systems have been merging with bigger groups: Local OB-GYN practices allied with Axia, and Penn Medicine acquired major institutions like Doylestown Health.

Consolidation, where smaller businesses combine to form a larger one, inevitably leads to reduced choice in marketplaces. More importantly, however, it results in less access to necessary services. House Health Committee Chair Dan Frankel testified last year on the significant role of healthcare mergers in closing hospitals in poorer areas, in favor of building hospitals in richer neighborhoods. Mergers will only further class inequality in America.

If fewer options aren’t enough, those few choices are also more expensive. We’re familiar with the College Board’s exorbitant prices, a feat it is only able to pull off because of its near monopoly on higher education preparation. We now risk having a private “College Board” dominate every industry, eliminating the need for corporations to offer the best services or products at the lowest prices to compete with others in their market.

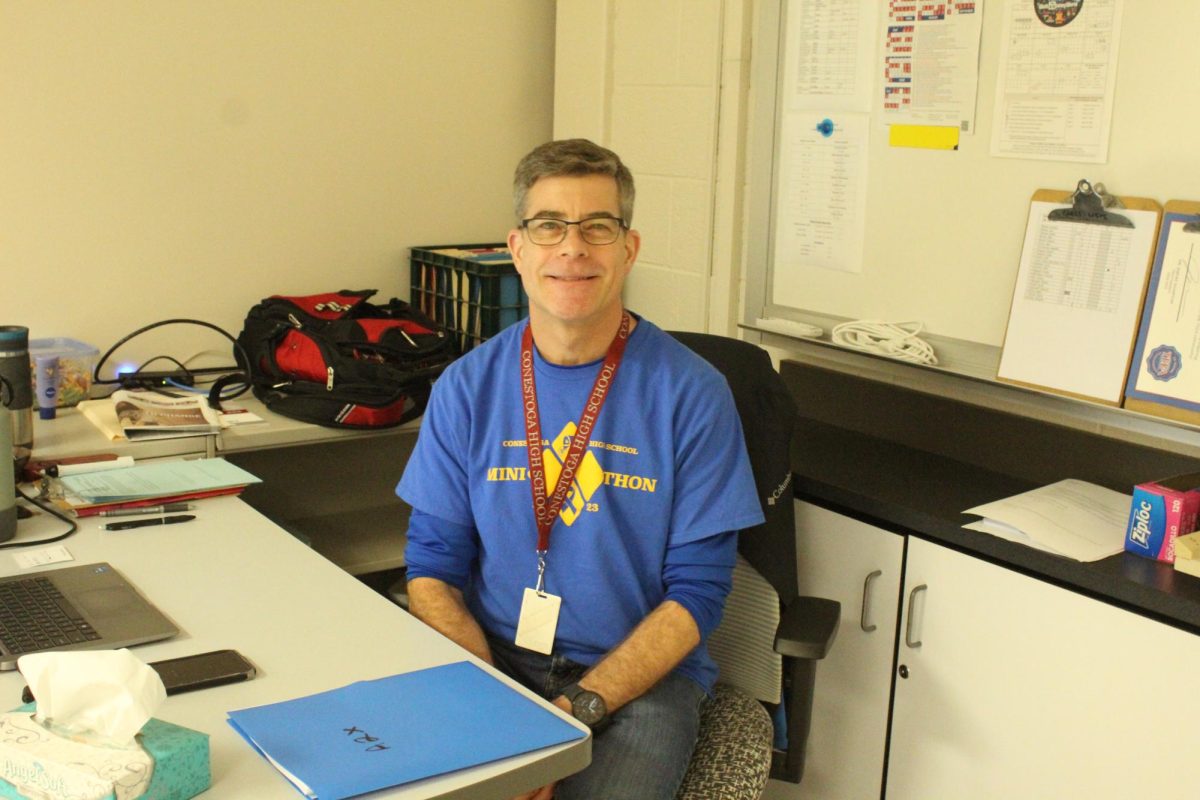

This private equity domination is especially concerning for healthcare: a 2022 Doximity poll of over 1,700 physicians showed 68% were very concerned with consolidation. Dr. Daniel Block, a psychiatrist in West Grove participating in the poll, commented that doctors’ views were being increasingly minimized by profit-driven corporations.

A major reason consolidation happens in the first place is due to financial difficulties. Dominant businesses tend to absorb their smaller competitors with the promise to keep them afloat. But once they merge, many of these large units still struggle. Reading Hospital acquired five hospitals in 2017 but soon closed two of those five and has been fighting bankruptcy since.

Since financial issues force many businesses and clinics to merge or close, we need to seek out ways to sustain smaller entities through voting and monetary support. It’s up to us to aid physician unionization and government intervention initiatives, as well as antitrust policies, to protect our rights as consumers and as future industry members.

With large corporations only getting larger, it’s time we ask who is really benefiting and who is getting lost in the money shuffle.

Juliana Yao can be reached at [email protected].