By Lily Chen, Design Editor

At the Jan. 22 TESD school board meeting, the board adopted a preliminary budget of $186 million for the 2024-25 fiscal year and decided to file for a tax rate referendum exception to the Pennsylvania Special Session Act 1 of 2006.

The district applied for permission to raise property taxes over the maximum tax rate increase for TESD, as defined in the district’s Act 1 Index, but has not yet decided if it will increase tax rates over the index.

The last time the board raised tax rates above its index was the 2019-20 fiscal year, with the special education and Pennsylvania State Employees’ Retirement System exceptions. This year, the school board applied for the same exceptions.

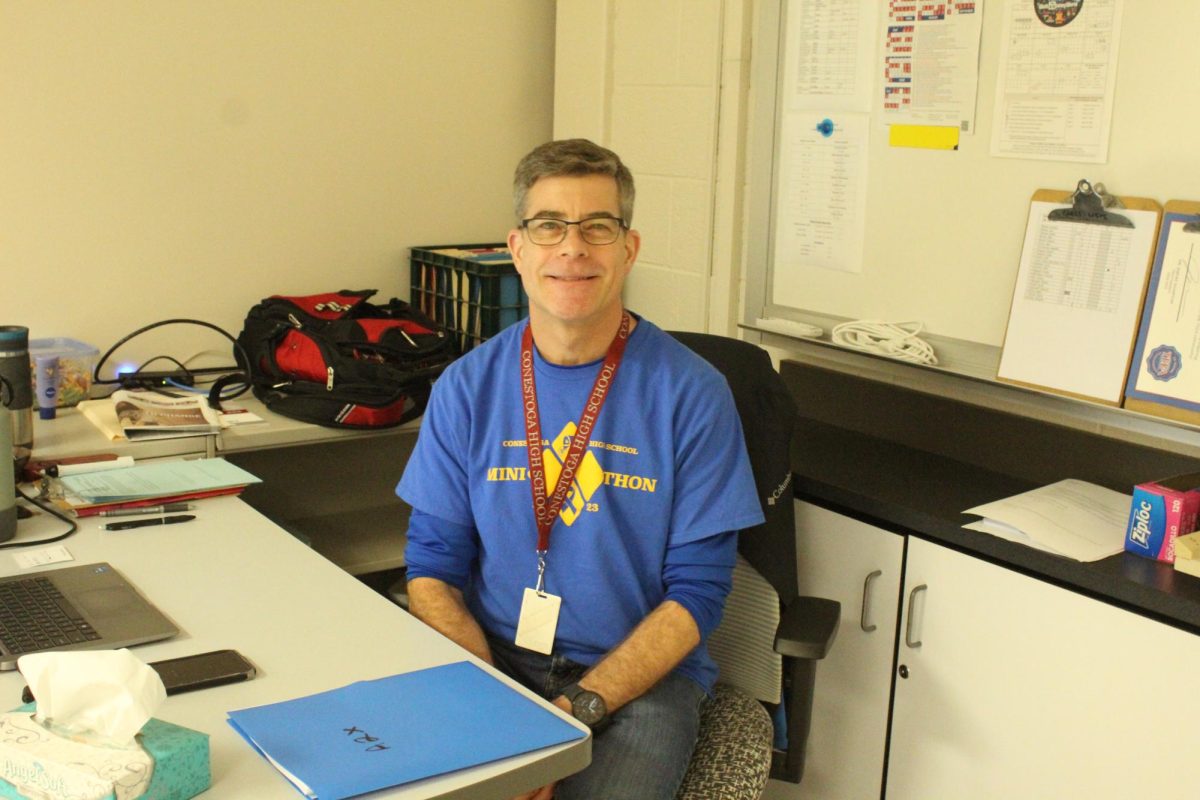

“The eligibility for those exceptions is determined through the State’s application process,” school board secretary and district business manager Arthur McDonnell wrote in an email. “After completing the applications, we could see that our previous projections were consistent with the State’s calculations that we would only be eligible for the Special Education Expenditures exception.”

Act 1 indexes vary between school districts and are calculated each fiscal year by the Pennsylvania Department of Education. The 2024-25 fiscal year Act 1 Index for TESD is 5.3%. The department adjusts a base index to be higher for lower-wealth districts.

If the department approves the exception, the school board does not necessarily have to raise tax rates above the index. Chair of the school board fi- nance committee Dr. Roberta Hotinski said that filing for referendum exceptions to increase tax rates is necessary to ensure flexibility in budgeting, as expenditures have increased due to capital projects such as the possible addition of a sixth elementary school.

“Because we are considering building the new school and there’s a big cash outlay upfront with the buying of the property of $16 million — which we’ve never had to do before — we decided to keep our options open at this point,” Hotinski said.

In addition to the district’s ongoing projects, Hotinski cites increasing enrollment as a factor leading to rising school district costs.

“We’ve had increases in enrollment, so any tax increase is really going to benefit all the students,” Hotinski said. “Anything we have in terms of a tax increase is going to provide more staff and also provide better facilities in terms of the school and the elementary schools.”

The Pennsylvania Department of Education has not yet ruled on the school board’s application.

The school board will discuss the budget in upcoming workshops on March 11 and April 8, with a proposed final budget set for adoption at the April 22 school board meeting. The board will approve the final budget at the last school board meeting of the school year on June 10.

Lily Chen can be reached at [email protected].