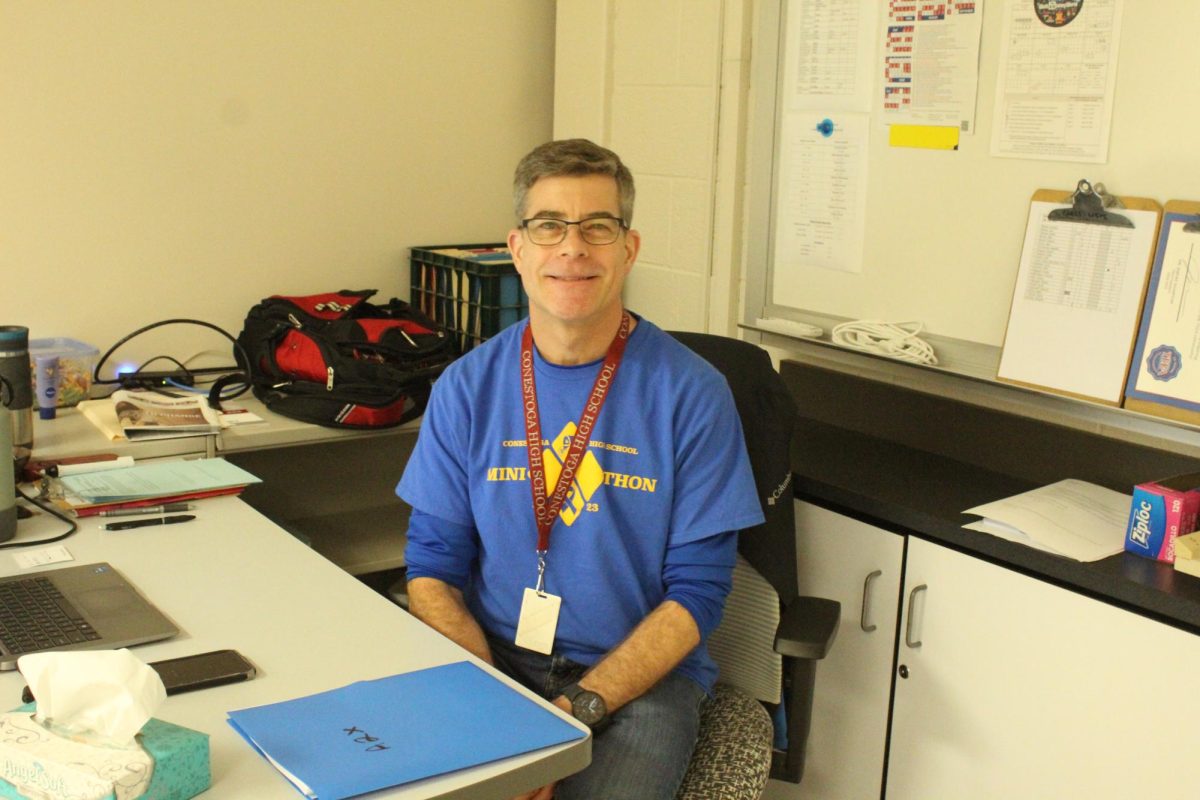

By Isabelle Emmanuel, Staff Reporter

In December, millions of high school seniors will be filling out the Free Application for Federal Student Aid (FAFSA) as part of their college application process. As outlined by the FAFSA Simplification Act, the U.S. Department of Education implemented changes to the FAFSA in an attempt to streamline the process of applying for financial aid.

The new form features a reduced number of questions to complete, shortening the number of questions from 108 to less than 50. Guidance counselor Rachel Reavy believes the simplified form will benefit students.

“The reduction of the questions was taking out some of the redundancy,” Reavy said. “(The FAFSA) will seem less cumbersome to families and less of an arduous task. Part of the reduced questions is they are automating things. It has more accurate data automatically loaded in.”

The 2024-25 FAFSA will become available in December rather than its usual release in October. The deadline is still June 30, 2025, but some states and colleges set individual deadlines as early as January. Senior Minseo You feels the date change will not have a significant impact on students.

“I don’t think the date being moved from October to December will affect seniors that much,” You said. “Even though it was pushed back further, they made the FAFSA application a lot shorter and easier to complete.”

The FAFSA is also changing its methodology to calculate aid. What was once the Expected Family Contribution metric is now the Student Aid Index (SAI). The SAI comes with a few key changes, such as the fact that the number of college-bound children in a family will no longer be a factor taken into consideration for aid.

“Many people are going to struggle with that. It’s going to make (paying for college) a little more challenging, and parents are going to expect to pay more,” Reavy said.

The SAI will now take into consideration the net worth of small businesses and farms when calculating the amount of aid received, when they previously could go unreported. This may reduce the aid given to families who rely on these assets.

“A lot of families used to hide money through their family businesses, so I think the government is trying to make sure that people are being more honest in their accounting,” Reavy said. “That’s going to be a significant change for lots of families, especially if (they’re) a farming family. They don’t have a lot of extra resources to utilize, and to utilize a house as an asset is going to be very different.”

You believes that the changes to the FAFSA will make it a less overwhelming task for her to complete.

“The changes will definitely make things simpler, especially for parents and students that are completing it,” You said. “It’ll be a much less intimidating process.”

Isabelle Emmanuel can be reached at [email protected].