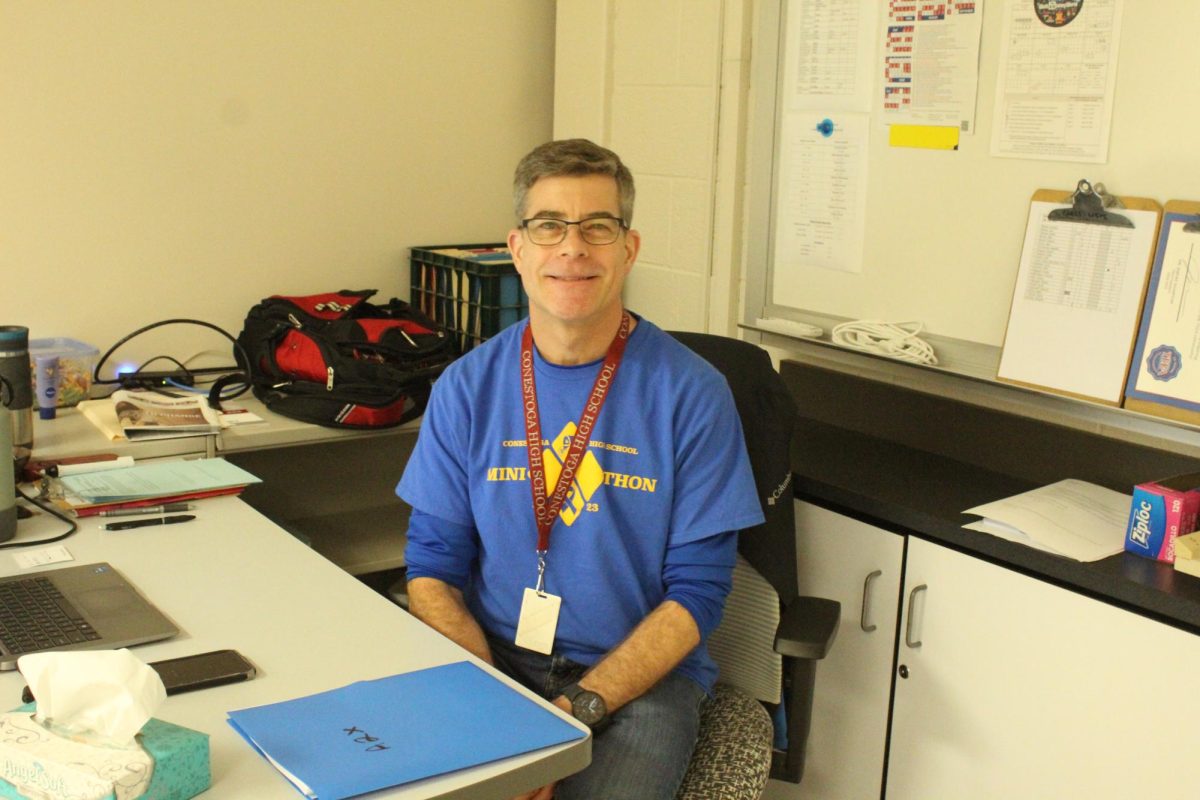

By Evan Lu, Webmaster

When you picture an investor, you probably imagine a Wall Street banker with a jet black suit and slick, gelled-back hair. But the six million members of the Reddit investing forum r/WallStreetBets are trying to introduce a new type of investor into the playing field: the retail investor. These everyday investors with little capital and training but big ambitions recently flexed their muscles by driving up stock prices, most notably that of GameStop, calling for a financial revolution against the institutional power of hedge funds and banks. However, their short-lived success is not enough to upend big money Wall Street investors.

A dwindling video game seller that relies on customers visiting their stores, GameStop is widely considered to be a tanking business model as it is quickly overtaken by competition from more convenient online marketplaces. Many investors, including hedge funds managing billions of dollars of assets, hope to gain from GameStop’s eventual demise by short selling its stock, essentially betting that the stock is going down to turn a profit. Massive hedge funds, like Melvin Capital and Citron Research, invested billions of dollars in the decline of GameStop.

In January, a group of Reddit investors collaborated to drive up the stock prices of GameStop and similarly failing companies to punish short sellers. Using stock-trading apps like Robinhood, they encouraged one another to buy and hold as many shares of GameStop as possible in a “short squeeze”. Within days, GameStop stock rose from $19 per share to nearly $500 per share at its peak, an increase of 2400 percent (shares have since dropped to $60 per share). Amidst the chaos, short selling hedge funds lost nearly 13 billion dollars.

The GameStop short squeeze is admittedly a scary shakedown for institutional investors. Even Reddit’s PR team joined in on the frenzy with advertising in the Super Bowl, flaunting the “victory of the masses” on one of the largest commercial stages. Freed from the shackles of limited capital by social media and commission-free brokerage apps, ordinary people can now band together and move the market on a large scale through coordinated investments. Their actions not only cost Wall Street managers billions of dollars, they challenged corporate power. Normally the ones controlling, influencing and manipulating the market, corporate power holders and Wharton-educated hedge fund managers were simply outplayed in an embarrassing match against unsophisticated couch potatoes.

Nonetheless, this incident is no “French Revolution of finance” as claimed by Anthony Scaramucci, Donald Trump’s former communications advisor, nor is it a harbinger of systematic change. Do not mistake this for anything other than what it truly is: a quick ploy to beat Wall Street investors at their own game. Unfortunately for retail investors, stock prices always end up at their true intrinsic value sooner or later, and while a few lucky people may strike big, there are and will always be people who are too late to the party and take the brunt of the fall. At the core, it’s a classic incidence of illusory superiority: normal investors overestimate their intelligence and ability to judge stock prices, often losing everything as a result. In truth, in an attempt to make some easy cash and stick it to the Wall Street snobs, these investors are gambling their life savings away in the casino that is the stock market. But remember, at the end of the day, the house always wins.